We provide strategies to land and expand your company in Germany.

- Consultinghouse.eu

- Platform

- Online e-commerce (OSS) services

WE PROVIDE ONLINE E-COMMERCE SERVICES FOR YOUR SELLERS IN GERMANY

Our platforms supports e-commerce seller to better manage their data in order to stay compliant in Germany.

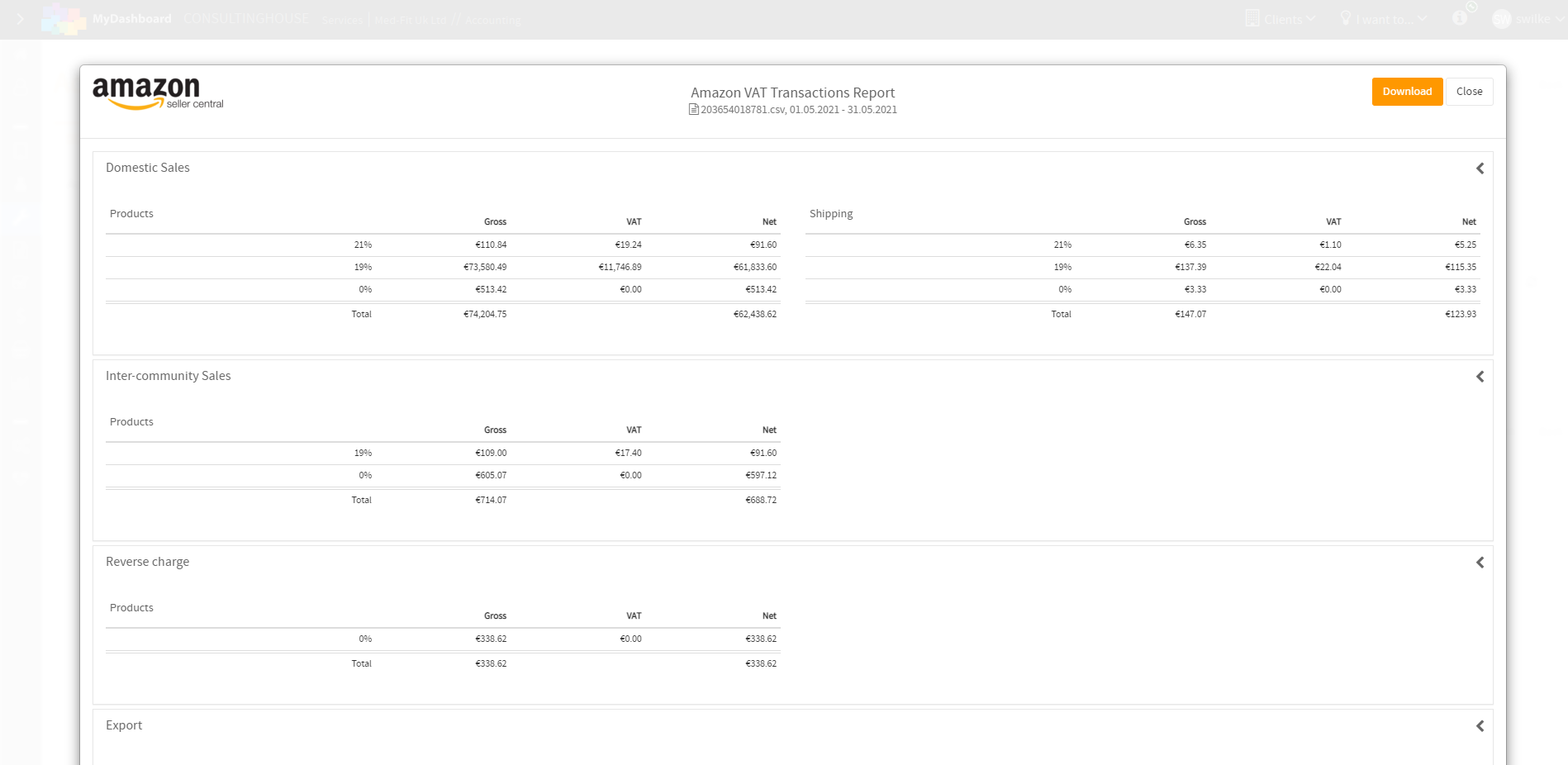

Amazon eCommerce Connector

The Amazon VAT Transactions Report provides detailed information for

- sales

- returns

- refunds

- cross border inbound

- and cross border fulfillment center transfers

generated through Amazon’s European Websites (amazon.co.uk, amazon.de, amazon.fr, amazon.it, amazon.es), Webstore by Amazon (WBA), and Amazon European Fulfillment Network (FBA and multi-channel fulfillment).

Consultinghouse can help you to quickly understand your Amazon transactions data in order to meet reqired VAT reporting obligations in Germany & greater Europe.

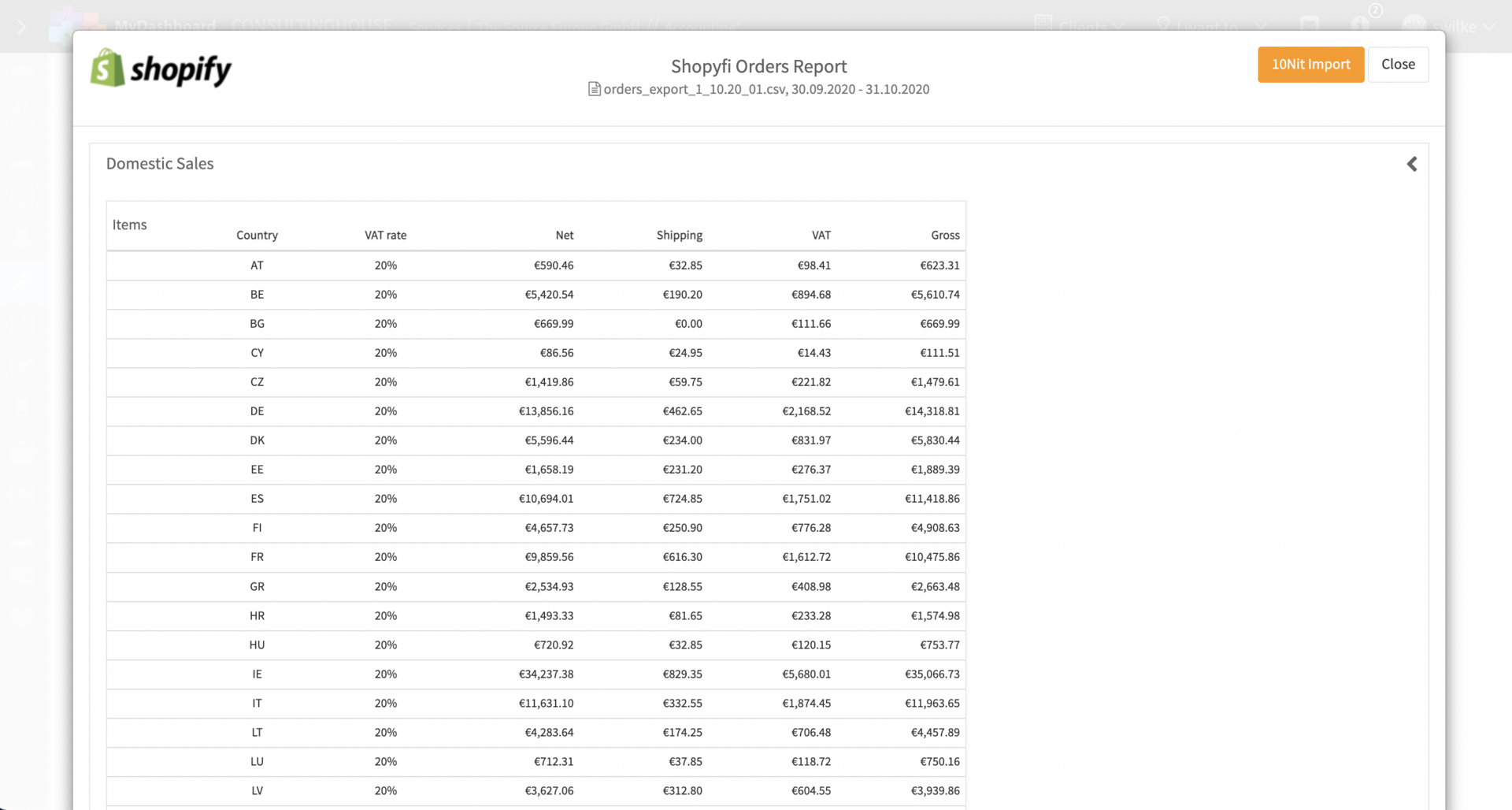

Shopify eCommerce Connector

Businesses of all sizes - Shopify startups and SaaS companies alike - use our software to allocate orders, payments and post them automatically.

- Automated identification of B2C sales

- Automated determination of your tax rates

- Handling of OSS registrations and reports

- Quality control for your transactions

YOUR PERSONAL POINT OF CONTACT

We provide a dedicated accounting* professional for each client who can be contacted via email, chat or phone.

Our objective is to provide our international clients with a unique experience and answers within one business day. We are here for you, so you can focus on developing your business in Germany.

INTRODUCTION TO OSS AUTOMATION

Selling products online has become a popular way of doing business in the modern world. E-commerce platforms like Amazon and Shopify have made it easier for small and large businesses to reach customers globally.

However, selling in Europe comes with its own set of challenges, including registration for VAT and compliance with tax regulations.

This page will provide a step-by-step guide on how to register as an e-commerce seller in Germany and how to manage and prepare sales transaction data from e-commerce marketplaces like Amazon and Shopify to be prepared for European OSS VAT reporting.

STEP 1: REGISTER AS AN E-COMMERCE SELLER IN GERMANY

The first step in selling in Germany is to register for VAT. To register for VAT, you will need to

- obtain a VAT identification number (VAT ID) from the German tax authorities.

- register with German ELSTER (The German online tax office)

- register with the German BOP portal

Please note that Consultinghouse and its partners can help international companies to successfully register as an eCommerce seller in Germany.

STEP 2: PREPARE AND PROCESS SALES TRANSACTION DATA

Once you have obtained your VAT ID, the next step is to manage and prepare your sales transaction data. E-commerce marketplaces like Amazon and Shopify generate a wealth of data about your sales transactions. This data includes information about the products sold, the price of the products, and the shipping and handling charges.

To be prepared for European OSS VAT reporting, you will need to ensure that all of this data is accurate and up-to-date. One way to do this is to use software that can integrate with your e-commerce platform and automatically extract the relevant data.

There are many software solutions available that can help you manage and prepare your sales transaction data. These include cloud-based accounting software like Xero, QuickBooks, and Sage. These software solutions can help you automatically extract data from Amazon and Shopify and generate accurate and up-to-date reports.

The challenge, however, is that most of those cloud-based accounting software is not certified to report VAT numbers to the German tax office. For this reason, software like Xero might be very useful for internal group reporting, however, they will also have their limitations with regard to staying compliant in Germany.

Today the only way to work around this obstacle is to partner with a local accounting firm and tax advisor in Germany in order to mirror the accounting in a German accounting system which is certified in Germany. This approach comes with additional overhead, as the accounting does does not only need to be kept redundant, but also as there is additional need for further communication and alignment between the accounting teams of companies and their local partners.

Please note that since in e-commerce often thousands of sales transactions need to be managed and processed on a monthly basis it is highly recommended to partner with the right provider who will not only report OSS data to the German authorities but also who is capable to understand and process the underlying data itself.

Consultinghouse e-commerce solutions help e-commerce sellers to turn their sales transactions generated by marketplaces like Amazon and Shopify into beautiful journal entries. Our e-commerce solutions will help sellers to automate their OSS reporting.

STEP 3: EUROPEAN OSS VAT REPORTING

Once you have registered for VAT and managed and prepared your sales transaction data, the next step is to submit your VAT returns. The European Union has introduced a new VAT reporting system called the One-Stop Shop (OSS) VAT reporting.

The OSS system allows e-commerce sellers to report and pay VAT on sales made to customers in other EU member states. This means that you can submit a single VAT return for all of your EU sales, rather than submitting individual returns to each member state where you have made sales.

To use the OSS system, you will need to register for the scheme in your European home member state. Once registered, you can submit a single VAT return for all of your EU sales, and the tax authorities will distribute the VAT to the relevant member states.

CONCLUSION

Selling products on e-commerce platforms like Amazon and Shopify can be a great way to reach customers globally, but it comes with its own set of challenges. Registering for VAT and complying with tax regulations can be time-consuming and complex, but with the right tools and knowledge, it's possible to manage and prepare your sales transaction data and be prepared for European OSS VAT reporting. By following the steps outlined, you can ensure that your e-commerce business is compliant with EU tax regulations and ready to sell in Germany and other EU member states.

- INTRODUCTION TO OSS AUTOMATION

- STEP 1: REGISTER AS AN E-COMMERCE SELLER IN GERMANY

- STEP 2: PREPARE AND PROCESS SALES TRANSACTION DATA

- STEP 3: EUROPEAN OSS VAT REPORTING

- CONCLUSION

TO LEARN MORE ABOUT HOW WE CAN ADD VALUE TO YOUR BUSINESS IN GERMANY, PLEASE DO NOT HESITATE TO CONTACT US TODAY!

LET US BE A PART OF YOUR SUCCESS STORY

WHY US?

- Strong experience in supporting foreign companies to develop their business in Germany

- Our clients success is our success. Our objective is to grow along our clients

- We are family owned. Our long- term perspective allows for good strategy and decision-making

Book your advisory call today

We help you to assess the current phase of your business and to build your personal roadmap about how your business can start and grow in Germany.

Market Entry Newsletter

Our newsletter covers the news you need. Subscribe now.

CONTACT US

To learn more about our services and how we can create value for our international clients when doing business in Germany, please contact us by filling out the following form. You also can get in touch with us directly

+49 (0) 6181 70115 30 or +49 (0) 618 125 03 30 or info@consultinghouse.eu

.png?width=512&height=512&name=union%20(4).png)